We partner with leading credit protocols to provide the deepest liquidity and available loans, so our users can build their diversified portfolios of real world assets on chain.

The vault allocates funds to junior pools on Goldfinch. Deposit USDC to get diversified exposure to high-yield junior tranches in private credit to financial technology companies.

The Goldfinch Diversified Junior Vault allocates cross high-yield junior tranches.

Investing in vault tokens comes with the following risks: default of payment from the original borrowers expected to provide payments to the loan tokens, governance risk in said tokens, smart contract risk, and native vault token risks, among others.

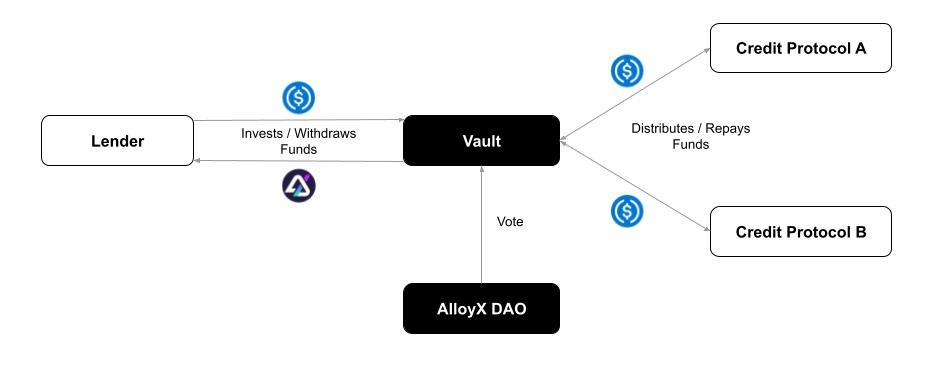

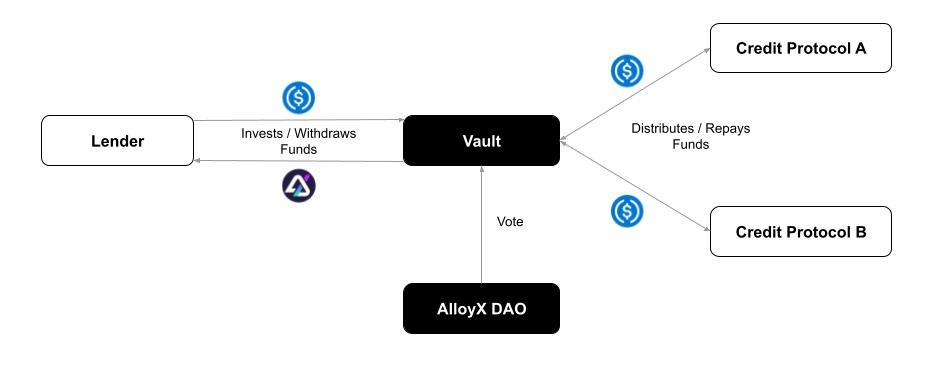

Users can lend their capital to a vault to earn a yield. Deposit USDC and receive vault tokens based on a floating exchange rate. Repayment will be automatically reinvested as it comes in, or be converted to USDC to meet redemption needs.

Users can choose to create their own vaults with targeted assets and desks sourced from partner credit protocols. To launch a vault, please contact the AlloyX team.

Real world assets aggregated and optimized for lenders. Achieve diversification with ease.

About

Products

2023 © Copyright Alloyx. All Rights Reserved